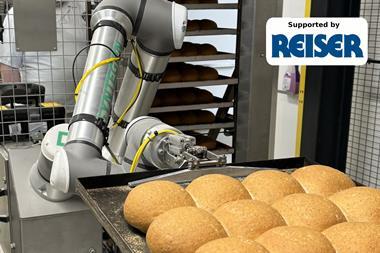

Medium-sized businesses have become a focus for suppliers of sheeting and laminating kit as bakers seek to automate labour-intensive operations.

Consistency, flexibility and competitive pricing are three things customers demand from a baker. They are also three things automated sheeting and laminating equipment can help to deliver, and three things mid-sized businesses are particularly well placed to offer.

Medium-sized businesses can offer economies of scale smaller operators may struggle to deliver, while being more agile than the largest plant operators when it comes to bringing new or modified products to market.

With today’s consumers – and consequently a baker’s trade customers – demanding products that offer greater variety while meeting the latest diet trends, it’s not surprising suppliers of bakery equipment are seeing increased demand from medium-sized businesses.

“The need to provide new, often healthier bakery products for consumers, continues to prove a spur to innovation,” suggests Stan Cauvain, director at bakery consultancy BakeTran. “With a flexible plant, medium-sized businesses are often better placed to exploit new opportunities.”

While very small or very large businesses may focus on a limited product range – such as handcrafted sourdoughs in the case of solo bakers and wrapped loaves in the case of a plant bakery – mid-sized businesses can offer a more diverse range.

“Medium-sized businesses tend to have a much wider product portfolio and therefore require equipment that is more versatile and adaptable, with the ability to change from one product to another quickly, with minimal downtime,” explains Richard Tearle, general manager at dough handling equipment supplier Rondo.

It’s a view echoed by Ann Wells, group marketing director at Brook Food Processing Equipment: “In a medium-sized business, bakers are looking for more flexibility to run multiple products, so equipment that can offer changeover without loss of time is crucial.”

And continued demand for new products can stretch equipment suppliers as much as it does bakers.

Gluten-free doughs, for example, can be highly hydrated, which can add complications when it comes to handling.

Bakers may also want to use dedicated equipment for them, and other products that raise concerns over allergens. However, equipment suppliers have continued to make huge strides in ensuring machines are easy to thoroughly clean.

Also raising potential challenges is the soaring interest in artisan-style and Continental breads.

Often highly fermented, these can have an open texture that again requires gentle handling.

“As doughs become more complex, and with the free-from movement showing no sign of slowing, there are constantly new challenges to be met,” says Tearle. “The constant evolution of new technology will be used to enhance the operating

interfaces and offer more versatility and faster size changes.”

Tearle adds that, as a business that operates around the world, Rondo is consistently asked to come up with solutions for new products, and it has a team at its head office in Burgdorf, Switzerland, to answer such questions.

Similarly, equipment supplier AMF Tromp says its first step when developing its machines is listening to the market.

“We look for new opportunities like gluten-free, clean-label and healthy food in general, and develop the best solutions in cooperation with the client,” adds AMF Tromp marketing coordinator Erik Smink.

Get the right product and equipment, and it can open up big possibilities for a bakery business.

Brook Food, for example, says it can supply sheeters, make-up lines, laminating lines and fully automated lines to suit all levels of production.

“This includes the flexible Polin Baker’s Table which offers a compact make-up line for many types of pastry and dough products,” says Wells. “And also the new-to-the-market Raumer range of laminating lines, which are ideal for businesses expanding into automated production from standalone machines due to their simplicity and ease of use.”

Scaling up production commonly requires equipment and plant that can deliver more consistent products to consumers, advises Cauvain, adding: “The scale of demand opens up opportunities for medium-sized businesses to service retailers and foodservice providers, in addition to the more traditional and local markets.”

While business expansion, and embracing the demands of the market, are certainly factors behind the adoption of sheeting and laminating equipment by mid-sized bakeries, costs and staffing are also key issues.

In the case of the latter, Brexit has compounded the labour shortage that had already been causing concern across the industry (see box out below).

“The decreasing number of workers from EU countries is contributing to the difficulty in recruiting staff who have the necessary skills to produce quality products consistently,” says Tearle.

He adds that, in addition to saving labours costs, automation can bring significant saving in terms of ingredients and waste.

Wells at Brook Food says her business has seen growing interest in automation as businesses seek to reduce the labour used in sheeting and lamination.

“Where medium businesses have grown to be using two or three pastry brakes, we are suggesting moving to a semi or fully-automated line where labour savings can be significant,” she adds.

A key concern for businesses upscaling by introducing automated sheeting equipment is ensuring their investment stands the test of time.

Wells advises that buying the latest technology available to the industry is a sensible move, alongside building in flexibility to allow for a change in products and production capacity as time goes on.

Cauvain at BakeTran agrees that flexibility is the key to future-proofing the role of sheeting and laminating equipment.

“However, to do so requires careful choices to be made as few plants are ‘fully’ flexible,” he says.

“At the beginning of a potential purchase of sheeting and laminating equipment, a key step is to try to consider not just what will be needed tomorrow, but also what new variations on the same theme may be needed in the coming months and years.”

He adds that such considerations can readily extend the useful life of a plant.

Meanwhile, Smink at AMF Tromp advises that bakers ensure they have enough space on the line, so it can be easily extended with tooling for future products.

“This is because you know what you make today, but you don’t know what the market will ask tomorrow,” he adds. “At AMF Tromp we would like to rise together with bakeries in their future planning and development.”

Rondo points out that its Smartline and MLC equipment have been designed as modular ranges.

“A customer can start with an affordable ‘I’ configuration that would give savings and improve consistency in the manual dividing and sheeting process,” suggests Tearle. “Then, in time, they could add to the line to enhance and totally automate the laminating and final sheeting process straight onto the product make-up line.”

While it’s very unlikely that the demands on baked goods suppliers are going to get any easier in future, the right equipment can certainly help to smooth out any bumps along the way.

A time of change in the equipment market

The past few months have brought changes in the European bakery equipment market, including the takeover of Fritsch Group by packaging specialist Multivac.

The deal followed family-owned dough handling equipment supplier Fritsch, which employs 600 staff and has a turnover of around €80m, filing for insolvency in April.

Last month. Multivac took over Fritsch and its subsidiaries in the UK, Russia, Poland and the US, which it said would enable it to offer complete production lines.

“This is another important step for Multivac in expanding our range of integrated solutions for processing and packaging food products,” explains Christian Traumann, Multivac director and group CFO. “Thanks to the processing solutions from Fritsch, we will continue to extend our presence in the baking industry, where we have been able to implement some very challenging projects for automated packaging.”

Fritsch equipment will continue to be developed and manufactured at its site in Germany, and will be sold via Multivac’s sales and service network. Multivac is to invest in its own subsidiaries to create specialised sales teams for the baking industry. In addition to the exisiting Fritsch management, a Multivac management team will be appointed to run the company as a standalone business.

Meanwhile, this year, sheeting equipment supplier Tromp Group and oven manufacturer Den Boer Baking Systems have been integrated under AMF Bakery Systems.

The businesses began operating as AMF Tromp and AMF Den Boer in February in a move designed to unify AMF’s global strategy. All three businesses are part of the Markel Food Group.

“As we fold Europe’s best sheeting, depositing, baking and handling technology into the world’s strongest bakery equipment supplier, we aim to put AMF Tromp and AMF Den Boer in the best position for the future: technologically, culturally and structurally,” said Markel Food Group CEO Ken Newsome at the time.

AMF explained that the move to “unified project management systems and cohesive global sales and service teams” was a direct response to the challenges bakers faced in growing their product ranges to meet evolving consumer demand.

“The addition of the AMF Tromp and AMF Den Boer teams and technologies to AMF’s existing capabilities will protect the synergies we’ve already established while leveraging the global support and service the AMF brand was built on,” said AMF Bakery Systems president Jason Ward.

He added that the new structure would mean its sales and engineering teams were better equipped to offer the best processing solutions while more effectively supporting customers’ expanding product needs.

Brexit: what is it doing to investment?

“There can be no doubt that the uncertainty this mess has created has reduced confidence and therefore investment.”

These are the words of one leading bakery equipment supplier, echoing sentiments felt by many in the industry over Brexit and the growing threat of an exit without an agreement.

At a time when businesses do not know what tariffs will look like in just a few weeks’ time, or what complications there may be when exporting and importing, it’s little wonder some have put investment in equipment on hold. And concerns will have only been made worse by currency fluctuations.

“The prospect of a no-deal has seen sterling decline against the dollar and euro, driving up the cost of imports and the value of commodities, which are priced globally,” says one industry expert. “This might result in unwelcome inflation, but ought to enable UK producers to compete more effectively against imports.”

In research undertaken for British Baker’s Bakery Market Report, 46% of respondents say they ‘agree’ or ‘strongly agree’ Brexit will negatively impact their business. This figure was just 10% in the 2017/18 survey.

For bakers that export, business may be lost to EU competitors who do not have to pay tariffs.

“The result will be, at best, lost growth,” suggests one insider.

But there are also potential upsides. Baked goods that are currently produced overseas and imported from Europe could be produced locally and cost less than imports.

“The prospect of a no-deal Brexit ought to encourage a much closer focus on this type of opportunity, for our nearest export market is going to be much harder to access,” says one industry leader.

And while acknowledging the likelihood of short-term price increases, some business bosses expect prices to fall back.

“The price of goods should decrease, as tariffs Brussels set in place will not apply, although this will depend on trading relationships we make with non-EU countries,” explains one.

Concerns over staffing, which will have been exacerbated by confusion over settled status and free movement, may encourage businesses to look to automation to reduce labour demands.

“There are always opportunities, and baked goods are daily foods and necessary,” says one European sheeting equipment supplier, adding that it continues to see possibilities in the UK market.

Equipment aimed at the middle market

With medium-sized businesses continuing to automate their bakery production, here is a selection of kit aimed at that sector of the market.

Raumer

Italian manufacturer Polin has created laminating division Raumer, which is introducing a new line of laminating equipment to the UK industry.

With a focus on simplicity and solutions, the Raumer range has been designed to offer the mid-range of the market complete automated laminating lines.

Available in the UK through Polin agent Brook Food Processing Equipment, Raumer machines offer continuous production of puff pastry or similar types of dough.

Their flexible design combines a high-quality product with an optimal hourly output, quick product changeovers and excellent hygienic specifications, according to Brook Food.

The laminating lines are available in a variety of configurations and can provide a customised layout.

Each system is managed using a touchscreen control panel to change all parameters and programming data.

Rondo

Rondo says its Smartline MLC (Modular Laminating Concept) ranges have been designed to offer versatility, fast size change and hygiene.

“They are aimed directly at the medium-sized business sector and, with over 60 Smartlines now operating in the UK and Ireland, we can say that this has proved to be the case,” says Rondo general manager Richard Tearle.

The machine is equipped with a unique, pivoting satellite head that enables it to form any type of dough into a regular, relaxed dough band, to optimise the feeding of make-up lines.

It can be adjusted to process highly hydrated bread dough of more than 85% hydration, through to short doughs.

“The same lines can be used for laminating and sheeting Danish and puff doughs equally efficiently,” adds Tearle.

Rademaker

The latest generation of Rademaker’s Sigma Laminators have been developed to offer higher levels of hygiene, and feature improvements such as better process control and simplified operation.

Rademaker adds that the Sigma Laminator is designed for high production efficiency and offers easy-to-remove tools, exchangeable scrapers and bins and various options to minimise cleaning.

Rounded edges and covers that can be fully opened on both sides of each unit feature throughout the system.

It has wider rollers to increase output while reducing the risk of damage and stress on the outer dough edges. When it comes to control, the main interface size has been increased to 12 inches, and 22- and 32-inch screens are possible. An iPad control is available to enable remote operation at any position in the line, allowing the operator to walk alongside the line to monitor and fine-tune production.

No comments yet