Investment in new bakery systems may feel out of reach for some manufacturers struggling to cope with the soaring costs of energy, raw materials, and labour.

Fortunately, help is at hand from equipment suppliers as well as regional investment funds and other finance schemes to allow bakeries to continue their growth journeys.

So, what finance options are available to cash-strapped businesses? And what part does maintenance of existing equipment have to play when it comes to futureproofing?

Refined finance

Rather than trying to cobble together the cash to buy equipment upfront, bakers could contemplate either an operational lease or a Hire Purchase (HP) agreement directly with the supplier.

“The purchase can be offset against tax”

Multivac is one such company, offering both options for its Fritsch bakery equipment via its long-term partner, Deutsche Leasing. Paul Johnson, Fritsch product manager at Multivac, says that an operational lease has the benefit of saving on capital expenditure, which can be utilised elsewhere in the business, while also maximising cash flow, and providing an attractive ‘buy back’ option on ageing systems.

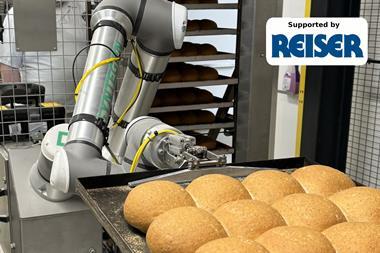

Reiser is another equipment manufacturer that provides flexibility through leasing plans. “The same plan opens the door for customers to upgrade equipment easily if required,” comments Reiser UK managing director Richard Watson.

For HP agreements, meanwhile, there is generally a small initial deposit followed by monthly payments plus interest, with the customer retaining ownership of equipment upon completion of the agreement.

“The purchase can be offset against tax,” highlights Johnson, pointing to the government’s Annual Investment Allowance which lets businesses claim deductions of up to £1m on certain plant and machinery from profits before tax.

Better borrowing

Another way to spread out costs for equipment purchases is by securing a loan from a local or regional bank or investment fund. This is very much dependent on location, with companies advised to check with local authorities, enterprise partnerships, Chambers of Commerce, or accountants to find the best options available to them which could potentially include some form of grant or match funding.

The Duplex Investment Fund (DIF), for instance, provides support to businesses within Coventry and Warwickshire looking to expand through investments in equipment. Once the machinery has been purchased with the loan, a 40% grant is reimbursed, which can also be used to cover the first 18 months of repayments.

These loans are usually between £30k and £150k and have a term of 60 months with an interest rate of 15.95%, and a 6.5% arrangement fee. Companies must be able to demonstrate a minimum of two years of profitable trading, a sound business plan with the need for a grant, and the creation of jobs as a result of the investment.

Established in 2019, the DIF is delivered by the Coventry & Warwickshire Reinvestment Trust, providing funds totalling more than £4m to 60 different firms including five bakeries to date. One of these is Handmade Speciality Products, which secured £150k in January to purchase new machinery for a new level of automation at the front end of its flapjack manufacturing process.

DIF funding is limited, but more is becoming available for Warwickshire-based businesses in the new financial year (from April). “Due to the attractiveness of Duplex it is on a first come, first served basis,” notes DIF marketing officer Angele Gulbinaite, who reveals that Coventry currently still has funding available.

Other regional schemes recently providing loans to bakery firms for investments include the Greater Manchester Combined Authority, which had HM Pasties borrowing £300k to set up a new larger site, and the Wales Flexible Investment Fund, giving £100k to help expand capacity of The Pudding Compartment in Flintshire.

Tech for granted

Bakery SMEs (companies employing less than 250 staff) may also consider applying for a match-funded grant from Made Smarter, the government-funded, industry-backed initiative that is focussed on supporting adoption of new technology. Funding of up to £20k for 50% of the project value is currently available to businesses in the North West, North East, East Midlands, West Midlands, Yorkshire & Humber and West of England.

Examples of bakeries accessing funding from Made Smarter include Studio Bakery in Lancashire and Bells of Lazonby in Cumbria.

Studio Bakery in Cumbria was able to create a digital roadmap and invest in a new cutting machine thanks to match-funding from Made Smarter. This enabled it to improve efficiency and enhance its finished products.

Meanwhile Bells of Lazonby, which recently relaunched the branding of its free-from sweet bakery brand We Love Cake, also accessed a Made Smarter grant to support its adoption of two programmable ultrasonic cutting robots. These have helped save a considerable amount of time in cake slicing and increase manufacturing capacity by an estimated 25%.

Will Kinghorn, technology adoption specialist at Made Smarter, notes there is also funding available to develop more state-of-the-art systems via partnerships with universities, research centres, and equipment suppliers. “In this case funding could be available through funding calls from organisations such as InnovateUK,” Kinghorn adds.

Maintaining a future

While the purchase and installation of new equipment are major considerations for a baker’s business plan, it is wise to put aside some budget for regular maintenance work.

The daily demands on bakery machinery make wear and tear inevitable, with costs adding up for unexpected outages that lead to production downtime, callouts, and repairs.

Equipment supplier EPP reminds that the manuals provided with the machinery include useful tips and advice on maintenance, such as recommended cleaning routines and fault finding. Most suppliers will also offer service contracts that have their own trained engineers visiting to conduct regular condition surveys and fit necessary replacement parts.

Watson at Reiser cites Vemag vacuum fillers and Variovac packaging machines as examples of systems with simple designs, meaning that replacing parts is an easy task it can demonstrate to bakery operators. “Furthermore, with extensive stock inventory for parts available in our Milton Keynes warehouse, replacement parts can be shipped to customers on short lead times, minimising disruption,” he notes.

Modern monitoring

Johnson asserts that both Multivac and Fritsch have taken maintenance to the next level by implementing ‘Smart Services’ software into their industrial bakery lines on 24/7 operation. This sees sensors monitoring the temperature and other parameters of key components in real time, sending warning notifications to specific personnel via email if limits are exceeded. “Predictive maintenance can help not only improve line performance but also save costs as components are replaced when necessary,” he adds.

In addition, the software can provide an overview of overall equipment effectiveness (OEE), check current system status, give reasons for any breakdowns, and review the production over the last 48 hours in relation to a planned target.

Components have a life of their own, mind, and not in a magical way. They can become obsolete, with a system upgrade required to ensure compliancy with the latest technologies. “These upgrades will prevent breakdown periods, preserve the maximum performance and reliability, and extend the economical and technical lifetime of the equipment,” comments Joris Mulders, sales director UK & Ireland at at Rademaker.

Bakeries with a solid business strategy via capex on technology now have various options to appease their financial worries. And by working smarter with what they have once they get it, they can maintain enhanced production and achieve long-term growth ambitions.

No comments yet