Cake Box has agreed to acquire Asian sweet treat specialist Ambala Foods for £22m, with £7m of the funds raised from new shares.

The egg-free cake franchise said the deal consists of £16m for the Ambala brand and £6m for its 42,000 sq ft production facility in Welwyn Garden City.

To part-finance the acquisition, Cake Box is proposing a placing of 3,888,889 new Ordinary Shares at an issue price of £1.80 per share to raise £7m. In total, this represents around 9.7% of the existing share capital in the company with new shares said to offer a 5.3% discount on the closing mid-market price at 11 March 2025.

An additional £200k is to be generated through a retail offer to existing shareholders of new shares at 1p each, while the remaining £15m will come from a new loan facility and the company’s cash resources, it said.

Ambala has been producing a range of ‘Mithai’ – desserts originating from the Indian subcontinent – in the UK since 1965 including bakery items such as baklawa (sweet pastries) and balushani (similar to fried doughnuts). Revenue had risen quickly from £11.2m in FY21 to £14m in FY23, but it revealed it had significantly underperformed in its most recent financial year following the death of founder and sole shareholder Mohammed Ali Khan in late 2023. Sales reached £14.3m for the 12 months to 31 October 2024 with underlying EBITDA of £1.8m.

The vast majority of Ambala’s sales are store generated – it currently operates 22 sites of which 19 are company-owned and three are franchised, with four more shops to be opened this year and six planned for 2026. At the start of 2025, Ambala had a total of 182 employees. All are to be retained following the acquisition, apart from the executors of the late founder’s estate including his son Ashfaq Khan, his widow Elizabeth Khan, and their lawyer, who will leave the company.

Cake Box said it was looking to expand Ambala’s online offering and seek opportunities through other retail channels. It also plans to cross sell products in stores and has identified around 100 locations where Ambala franchises could potentially be run by its existing franchisees. As of 30 September 2024, the Cake Box retail estate comprises 232 outlets nationwide, which are all franchises.

There is also significant oppoertunity to improve profitability of the Ambala business, claimed Cake Box, with efficiency gains potential of at least £1m identified in various areas such as production automation and the merging of head office, suppliers, and delivery fleets.

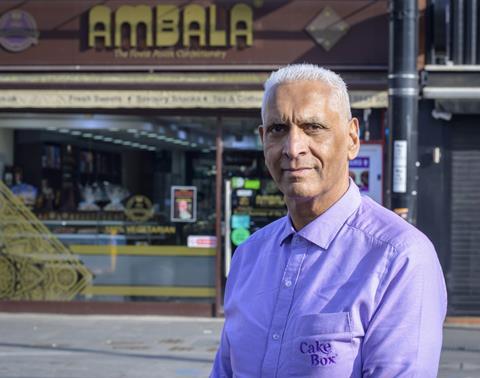

Cake Box CEO Sukh Chamdal commented that the strategic acquisition represented a significant opportunity to leverage the strengths of both brands to expand market presence and accelerate growth. “Ambala’s rich heritage and established customer base complement Cake Box’s values and commitment to quality and innovation,” he said.

“By adding Cake Box’s expertise and resources to Ambala, we aim to create a unique blend of traditional and contemporary delicacies that appeal to a diverse audience, ultimately driving growth and profitability,” added Chamdal.

Cake Box said it had continued to see improvement in sales year-on-year since its interim results for the six months to 30 September 2024, which reported a 4.3% increase in group revenue to £18.7m compared to the same period the year prior.

The company noted its sales had surpassed £4m during the festive period and had a record-setting trading week at the start of 2025, with online sales also continuing to be strong and averaging around £400k per week. Cake Box said it was now on track to open more than 25 new stores during its latest financial year, ie. the end of March. It recently appointed Andrew Boteler as a non-executive director to help enhance its operational integrity and transparency.

No comments yet