Greggs has been named the UK’s strongest brand in 2025 by valuation consultancy Brand Finance.

The bakery chain, which last year came second to accounting firm Ernst & Young, has continue to grow its business nationwide with turnover surpassing £2bn for the first time in 2024.

Brand Finance publishes an annual list that ranks British companies on their brand strength, based on the efficacy of performance on intangible measures relative to competitors. A balanced scorecard of metrics is said to be used to assess marketing investment, stakeholder equity, and business performance, with equity carrying double the weight of the other two. Calculations are then expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

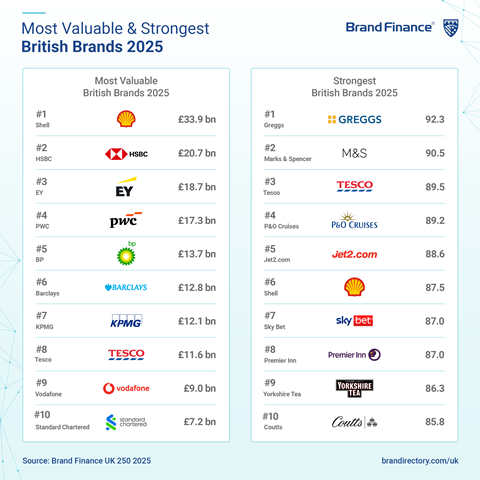

With a 7% increase in brand value – calculated at £958.6m – Greggs improved on its BSI score of 88.2 last year with a 92.3 in 2025. This was comfortably clear of its closest rival, Marks & Spencer, which leapt into second with a 90.5 score after placing 20th in the previous year’s list. Tesco also bettered its ranking, moving up from eighth to third in scoring 89.5.

Both Greggs and M&S earned the highest possible brand strength rating of AAA+. However, Brand Finance noted that the valuation had been conducted as of 1 January 2025, and so did not account for the April cyberattacks that affected M&S’ operations and services which is estimated to cost it around £300m in lost profits. Meanwhile, Greggs has seen a slowdown in sales growth this year with its latest trading update revealing it is anticipating full year operating profit to be “modestly below” that of 2024.

On the Most Valuable British Brands 2025 list, also published by Brand Finance, oil and gas company Shell retained the No. 1 spot for the ninth consecutive year, although it dropped 16% in brand value to £33.9bn. Tesco was the only food business in the Top 10, placing eighth with a brand value of £11.6bn.

Annie Brown, valuation director at Brand Finance, commented on how the coffee and bakery landscape in the UK has evolved significantly. “The rise in popularity of European influence, artisan bakeries and the decline of the traditional bakery is observable from cities to villages all over the nation,” she said.

“But one brand continues to preserve the traditional products and value positioning of a British bakery and is reaping the rewards among the UK public as a result. Greggs pulls ahead due to very strong familiarity, brand love and recommendation. All of these measures are likely boosted by its continued expansion of stores, lengthened opening hours, widened menu and continued commitment to value,” added Brown.

Notably, Costa Coffee dropped out of the Top 10 Strongest Brands list this year having come in seventh in 2024, ahead of Tesco and KitKat.

“Intensifying competition both in and out of home for coffee consumption as well as rising costs has led to financial challenges for Costa Coffee’s flagship coffee brand,” said Brown. “However, the brand remains strong with a AAA- rating, ahead of Starbucks on brand strength in the UK (86 vs 76) and Costa Coffee continues to invest significantly in renovating stores. Given the strength of the brand, Costa is a key brand to watch in the years ahead.”

No comments yet