There are stormy days ahead for the UK’s bakers as the upcoming breadmaking wheat harvest is predicted to be the smallest in over a decade.

The forecast follows plenty of stormy days too as the second soggiest winter-spring period on record is a key contributor to the poor harvest.

Cocoa supply has also fallen foul of extreme weather, resulting in soaring prices for chocolate in recent months. Just like the sweet bakery manufacturers finding ways to cope with the cocoa loco market, bread makers nationwide may well be wondering what course of action to take.

So, what is the current situation? What impact will this have on prices and quality of breadmaking wheat? And how can technology play a part in alleviating some of the challenges?

Flooding the market

Excessive rain reduces the yields and quality of wheat by causing issues not only in planting but also in crop husbandry, notes Nick Mitchell, procurement manager at bakery ingredients supplier Puratos UK. Tractors cannot spray fertilisers when it’s too wet, fungal infections such as root rot can be triggered, and nutrients can be diluted leading to changes in grain composition (starches, proteins, fibres etc). “This is a particular concern for breadmaking flours, given the higher quality standards required for these grades,” adds Mitchell.

The aforementioned wet weather has USDA estimates pegging UK wheat production at 10.9Mt this year, almost a quarter off the 14Mt harvested in 2023. It predicts wheat area across Britian to fall by 15% to 1.5m hectares.

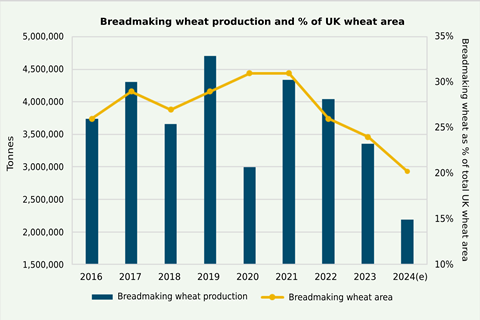

“The situation is even more severe for breadmaking wheat owing to a significant decline in popularity of milling wheat varieties,” reveals Joe Brennan, head of technical at UK Flour Millers – a trade body which represents the milling industry. “Industry estimates indicating the breadmaking crop could be down 35% on 2023 and the smallest in 11 years.”

With demand remaining high for milling wheat despite increasingly limited availability, the gap between its price and that of feed wheat has been widening. Latest data published by the Agriculture and Horticulture Development Board (AHDB) for the week ending 20 June 2024 has UK spot ex-farm bread milling wheat (ie. the price paid to farmers) averaging £64.80 per tonne more than feed wheat. This is more than double the five-year average for May of £29.50 per tonne. “Premiums will likely stay historically high due to short domestic supply,” comments Olivia Bonser, AHDB’s senior analyst for cereals & oilseeds.

Wheat from further afield

Homegrown wheat typically accounts from between 80% and 90% of the required volume used in the UK, although it is said to have hit 93% last year. UK Flour Millers’ Brennan claims that only about 35% of British wheat was used here back in the 1970s, but baking technology advances and breeding of wheat varieties better suited to our climate have helped facilitate much greater usage nowadays.

However, with UK milling wheat stocks already running low after a relatively small crop last year, there’s been an uptick in overseas wheat used by UK flour millers. “Given the exceptionally small UK milling wheat crop we expect this coming harvest, we anticipate this trend will continue over 2024 and into 2025,” says Brennan.

High protein wheat from Germany substitutes well for its UK counterpart, although the country has also had a troubling start to the season with too much rain causing wheat area to be down 8% and a decline in overall production expected. Canada has reportedly fared better, with its wheat offering good gluten strength and easy blending with UK varieties. The US is another popular source of breadmaking wheat, while wheat from France tends to be softer and more suited to French-style products.

Mitchell at Puratos also mentions tenders from countries such as Tunisia, Bangladesh, and Jordan, which have driven a more competitive market in the UK.

In addition, the Ukraine conflict has resulted in higher costs of nitrogen fertiliser with growers reluctant to apply as much on their crops at the risk of failing to meet milling wheat quality requirements. “Every country faces challenges that can affect quality or quantity, but this is the reality with any arable crop,” reminds Mitchell. “The global supply chain is flexible enough to cope with any issues, but inevitably changes to quality and quantity impact price.”

Separating the wheat from the chaff

As with many top-quality ingredients where named variety, regenerative status, or other provenance is required, breadmaking wheat carries a risk of food fraud.

This can impact product quality and brand reputation, and lead to severe financial implications for bakers, warns Bal Chand, the international marketing manager at ingredients marketplace TraceGains. “Effective supplier management programmes are crucial in combating this issue,” he adds.

Chand highlights four key strategies that manufacturers should consider to enhance transparency and trust and ensure the risk of wheat fraud is reduced. These include:

- Advanced Risk Scoring: implementing scoring algorithms to help highlight the most reliable supply chain partners and identify those needing improvement – Vulnerability & Threat Assessment Critical Control Points (VACCP & TACCP) can be undertaken on raw materials

- Comprehensive Supplier Audits: conducting thorough digital audits and maintaining detailed records allows bakers to continually monitor supplier performance

- Real-Time Monitoring: utilising robust tools to track supplier compliance in real time ensures that any deviations are quickly identified and addressed

- Horizon Scanning: advanced tools help anticipate potential risks, including food fraud, enabling bakers to take pre-emptive actions and safeguard their supply chains.

Brennan at UK Flour Millers believes the risk of fraud for British breadmaking wheat is low due to the vigorous quality assessments already in place. “Premia for wheat are linked to its quality, which is assessed by highly trained and audited laboratories when grain arrives at the mill, so in that sense it is a very difficult commodity in which to try and fraudulently pass of one grade of wheat as another,” he comments. “Furthermore, in the UK, millers buy specific varieties and can identify these.”

Getting smart

The practices of wheat growing, milling, and baking may be many centuries old, but modern technologies can aid better yields, sourcing, sustainability, and baking results.

Brennan reveals that innovative agriculture solutions are being developed by plant scientists both on home soil and abroad. For example, researchers at the John Innes Centre in Norwich have recently trained AI to identify wheat diseases at early stages in the field, which will help farmer tackle them quicker, limit their damage of crops, and make plant protection product sprays more efficient.

There’s also research being done at the International Maise and Wheat Improvement Centre (headquartered in Mexico) towards breeding a trait into elite wheat varieties that enhances their ability to absorb nitrogen from the soil. “This breakthrough could see much more efficient uptake of nitrogen fertiliser, reducing the environmental impact of wheat production and costs for farmers,” notes Brennan.

Despite the inglorious UK weather disrupting the wheat harvest once again, British breadmakers are being assured that, come rain or shine, they won’t be left high and dry in terms of ingredients. George Mason, senior executive at flour supplier Heygates Ltd and chairman of the UKFM Wheat Committee, says: “Over the seasons flour millers have become able to adapt to every eventuality that has confronted them to be able to continue to supply demand with the quality products they require”.

ADVERTISEMENT: TRACEGAINS

TraceGains is revolutionising the baking industry with a networked platform enabling bakery brands to collaborate seamlessly on over 550,000 ingredients and items, managing over 8.5million documents across more than 78,000 global supply chain locations. This networked connectivity fosters greater agility, resilience, and sustainability within your business ecosystem. By linking ingredient data and people in innovative ways, TraceGains empowers bakers to streamline operations, ensure compliance, and accelerate new product development. Transform your supply chain into a well-coordinated, transparent, and efficient network.

Join the community of forward-thinking bakeries who are mastering the modern supply chain with TraceGains and experience:

- 30% reduction in time-to-market

- 50% less time spent on sourcing and supplier approval time

- 75% reduction in out-of-spec lots

- 80% of their suppliers already on the network

Bake smarter, not harder, with TraceGains.

No comments yet