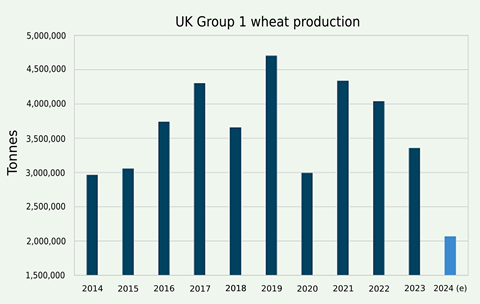

The UK breadmaking wheat harvest could be the smallest in over 10 years and down almost 40% on 2023, according to the latest industry data.

Trade body UK Flour Millers, which represents the milling industry, has warned that the wet weather and high prices of nitrogen fertiliser are impacting the yield and quality of this year’s crop.

The second wettest August to February since 1837 has severely limited the planting of wheat in the UK, with official estimates indicating the UK wheat area will be the second smallest since 1980. Additionally, current prospects for yield also look poor, with prolonged wet weather having damaged and stunted the development of wheat that farmers were able to plant, it added.

“The poor outlook for the upcoming UK wheat harvest is going to pose a real challenge,” said UK Flour Millers head of technical, Joe Brennan. “For milling wheat this is exacerbated by the decline in popularity of high-quality breadmaking wheat varieties, Group 1, which make up the backbone of UK flour milling demand.”

An estimate of breadmaking wheat production for 2024 based off the forecasted area and yields from previous years indicate the upcoming harvest could be the smallest in over ten years and down almost 40% on 2023.

Even though the prices of nitrogen fertiliser have dropped from their peaks, prices continue to be around 40% higher than before the Russian invasion of Ukraine. This, UK Flour Millers said, was limited production of breadmaking wheat that meets quality specifications.

It pointed to a recent Cereal Quality Survey by the Agriculture and Horticulture Development Board (AHDB) which indicated that only 13% of Group 1 breadmaking wheat met the typical milling quality specification, compared to 33% in 2022. This is reflected in the wheat market, with the spread between breadmaking and feed wheat prices since 2023 over twice as high as previous averages.

“We’ll be going into next season very low on homegrown quality breadmaking wheat, which will make next season even tighter,” Brennan added.

Wheat planted in prolonged wet conditions tend to generate very shallow roots, making it vulnerable to drought later in the season; weather is set to be a key watchpoint for the coming months. Weather in Germany will also be closely monitored, as farmers there have faced similarly extreme wet conditions over the wheat planting window.

“It’s a bit of a perfect storm, as high protein German wheat is normally the substitute for British breadmaking wheat if we cannot get enough at the right quality in a season. Farmers and millers are hoping for kinder weather in the months leading up to harvest,” Brennan concluded.

No comments yet