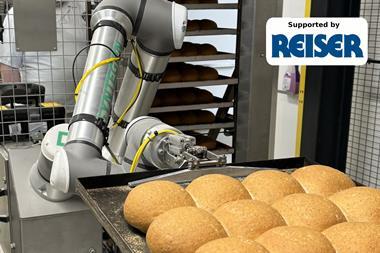

With the major retailers taking different approaches to in-store bakery, which strategy now seems more likely to win consumers’ spend?

Two major supermarket chains have recently shown very different approaches to their in-store bakery operations.

In February, Tesco announced it was axing scratch-baking in 58 stores and reducing it to only the most popular products in more than 200 other sites. Morrisons, meanwhile, had said it would ramp up the number of staff employed on its Market Street bakery counters – and even offered to give Tesco workers at risk of redundancy the chance of interviewing for a job in its own bakeries.

What does such a difference in attitude suggest for the future of in-store bakeries (ISBs)? Can we expect to see more businesses go the way of Tesco and rely more heavily on bake-off over scratch?

A key reason given by Tesco for its ISB shake-up, which is being implemented this month, was the shift in consumer demand away from traditional products.

Supermarket scratch baking is typically focused on more traditional lines, such as white loaves and baguettes, and this is not where growth is to be found. One of the big success stories of recent years has been artisan-style speciality breads. For supermarkets, these are usually bake-off.

Basing an in-store offer on bake-off alone requires fewer, less-skilled (but not unskilled) bakers

A larger factor, arguably, is cost.

“There are two areas for extra costs associated with scratch in-store baking; one is the need for investment in mixing and make-up plant and the other is related to staffing levels and skills,” says Stanley Cauvain of bakery consultants BakeTran.

“Basing an in-store offer on bake-off alone requires fewer, less-skilled (but not unskilled) bakers, which is probably where the greatest saving would be made.”

Loss of floor space is also a factor, points out industry veteran Brian Clarke of European Food Consultants, who says studies have shown that higher-value goods could be sold in floor space if it were released from a scratch operation.

Retailers may continue with scratch in the larger stores as footfall is greater and turnover may give them the return they require

Given this, is it likely we will continue to see businesses move away from scratch operations? Having a bake-off-only offer doesn’t seem to be doing Lidl or Marks & Spencer any harm. Both have seen growth in the category, and M&S was named Supermarket Bakery Business of the Year in the 2019 Baking Industry Awards.

Cauvain says consumer demand for a wider range of products will be a factor in a gradual shift away from scratch baking.

“As this happens, it becomes more difficult for in-store bakeries to deliver the scratch-baked options required,” he adds. “In some cases this may be related to the production volumes and limited space. In other cases it may be because more specialist equipment and a wider range of specialist ingredients are required.”

Retailers may continue with scratch in the larger stores as footfall is greater and turnover may give them the return they require

The shift away from scratch will be seen particularly in smaller stores, suggests Clarke.

“Like any business, retailers need the return on spending. They may continue with scratch in the larger stores as footfall is greater and turnover may give them the return they require.”

Ultimately, changes to ISB operations will be driven by whether they meet consumer expectations when it comes to choice and product quality.

If a retailer can meet these expectations, then shoppers may be unconcerned whether a loaf has been produced from scratch or taken out of a freezer, as Clarke found out when he once undertook an in-store consumer survey as part of a project to establish consumer understanding of scratch versus bake-off.

The vast majority simply said: “Of course this is baked in-store”. While some even responded: “Why are you asking me this – I can see the bakery over there!”

Sweet making: keeping up with demand

One reason bake-off is so popular with retailers, suggests supplier Dawn Foods, is that it can be hard for in-store bakeries (ISBs) to keep pace from the changing demands of consumers.

“New product development is driving the sweet bakery market,” according to Dawn marketing manager Jacqui Passmore. “Offering a large, ever-changing product range baked from scratch can prove difficult for in-store bakeries as this requires staff resource and time.”

This has resulted in more retailers opting for bake-off as the convenient alternative to help meet consumer demand, she adds.

As shown in the recent actions by Tesco and Morrisons (see main article), retailers are taking different approaches to their in-store bakeries but availability of fresh bakery products throughout the day remains vital.

“A combination of bake-off products and thaw-and-serve products can deliver a high-quality standard, while freeing up more time for staff and allowing more availability,” suggests Rich’s marketing director John Want.

And retailers seem to be getting the mix right, with sales in the sweet in-store bakery category up 5.9% year on year [Kantar 52w/e 22 March 2020].

“Sweet in-store bakery was in strong growth ahead of the Covid-19 lockdown, recovering to the point that it was three years ago,” explains Want. “This is because shoppers were purchasing in the category more frequently and putting more in their baskets, although the number of shoppers in the category is currently flat.”

Young families and empty nesters have contributed to the growth, but pre-family shoppers are the key driver of spend in the past 12 months. However, only 78% of this group purchase sweet ISB goods, points out Want.

“While the market will of course see a dip as a result of the lockdown, there are opportunities for growth with this demographic, as well in local convenience outlets.”

Cookies remain one of the success stories in the ISB category and, although chocolate remains the firm favourite, there is plenty going on in terms of NPD.

Dawn’s current seasonal bake-off range includes: a Blueberry, Banana & White Chocolate Cookie, described as ideal for serving at breakfast; an Apple & Cinnamon Cookie, featuring a lightly spiced dough; and a Caramel Latte Cookie with salted caramel fudge pieces and a caramel latte flavour.

No comments yet