Packaging is becoming a hot topic in the baking industry, with businesses coming under pressure from multiple sides.

Consumer demand for use of environmentally friendly materials is rising, there’s new and existing taxes on non-recyclable waste, and it’s an obvious area in which companies can enhance their sustainability credentials.

Changing things can be complex though. So, what progress has been made to reduce plastic and increase recyclability of bakery packaging? And what are the factors driving and impeding change?

A scheme skewed against SMEs

One of the reasons why packaging is high on the agenda at the moment is the introduction of the Extended Producer Responsibility (EPR) for packaging scheme. This applies the ‘polluter pays’ principle in that it shifts the cost of managing household packaging waste from taxpayers and local authorities to manufacturers.

First proposed by the Department for Environment, Food & Rural Affairs (Defra) in December 2018, and then revised in March 2022, it sees all UK businesses with a turnover of £1m or more that import or supply over 25 tonnes of packaging to the UK market per year fall under its scope. The legislation came into force at the start of this year and required all organisations to have submitted their packaging data (timescales vary by size) by 1 April while registering with the environmental regulator. Tax bills are to start arriving this October, with illustrative base fees now available.

The government is expecting to generate more than £1bn from the scheme annually and has also unveiled a new administrator called PackUK to work on raising fees from obligated producers and make packaging waste disposal payments to local authorities in return for the delivery of better collection and recycling services.

“This feels like, yet another layer of pressure placed on small businesses”

It’s a good idea in theory, as it encourages businesses to use more recyclable materials and minimise excess packaging. But the scheme appears designed more for the large-scale manufacturers and could have a devastating effect on the cash-strapped craft bakery sector.

“The EPR thresholds themselves are not entirely clear, which only adds to the uncertainty facing SME bakery businesses,” commented Karen Dear, chief executive of the Craft Bakers Association (CBA). Understanding the potential impact of these changes, she notes, will require a significant investment of time and resources – a burden that extends far beyond financial cost.

“Coming so soon after the substantial expenses and operational upheaval caused by the introduction of mandatory waste separation, this feels like, yet another layer of pressure placed on small businesses at an already exceptionally challenging time,” adds Dear. “While our members are fully committed to environmental responsibility, it is essential that government ensures clarity, proportionality, and practical support in the rollout of these measures.”

To make things worse, heavier packaging materials such as glass are disproportionately penalised in the current EPR. This could mean companies could end up paying far less for using plastic than glass, which has a much higher recyclability rate in the UK. In reaction, a growing group of SMEs led by ManíLife founder Stu Macdonald, including food manufacturers and some bakery brands, are calling for reform of the fee structure including a more favourable phase-in model for businesses with a turnover under £36m.

More laws here and abroad

There is another legislation that UK bakers who export to Europe should be wary of: the Packaging and Packaging Waste Regulation (PPWR). This is set to introduce common rules for labelling and marking requirements for various packaging formats across EU member states from 12 August 2026. All British exports into these countries need to respect the provisions too.

European trade body, the Federation of European Manufacturers and Suppliers of Ingredients to the Bakery, Confectionery, and Patisserie Industries (Fedima), welcomed the PPWR’s formal adoption by the European Council in December last year. Chair of Fedima’s Sustainability Committee, Jean-Philippe Michaux, believes an EU-harmonised labelling system is essential to prevent market fragmentation, ensure the free movement of packaged goods within the EU, and to support consumers in correctly sorting their waste. “For our industry, this means transitioning towards materials and designs that enhance recyclability and reuse while maintaining the safety and quality of bakery products,” adds Michaux.

The UK introduced a Plastic Packaging Tax in 2022, with Spain and Italy following suit a year later and Germany implementing a levy in 2024. Here, the tax has increased each year with its latest rate (from 1 April) standing at £223.69 per tonne of manufactured or imported plastic packaging containing less than 30% recycled content.

This also sounds good on paper but can be problematic for certain applications. Phoebe Winsor, UK CSR and decarbonisation lead at sweet bakery supplier Mademoiselle Desserts, warns that plastic with higher recyclable content is not always feasible for direct food-contact mono-packaging unless it undergoes heat treatment. “Additionally, for food-contact packaging to be recycled, it needs to be clean, yet there are often limited facilities available for this process,” she asserts.

David Moore, head of ESG at The Compleat Food Group, is looking forward to kicking flexible films to the kerb, in a literal sense. They remain an industry-wide challenge due to current recycling limitations, he notes, but says Compleat – which manufactures bakery brands including Wall’s, Wrights, and Pork Farms – is proactively preparing for future developments. “With kerbside collection of flexible films expected by 2027, we have already introduced mono-material films for some products, making them recyclable via supermarket collection points and, eventually, at the kerbside,” he contends.

Efforts have also been focused on phasing out black plastics, as they are more difficult to recycle due to challenges in detection by recycling facility machinery. Frozen baked goods brand Frank Dale took this initiative back in 2023, replacing black plastic from operations with clear 70% recycled plastic and corrugated board. The plastic used is rPET, which stands for Recycled Polyethylene Terephthalate, a highly recyclable material which helps minimise waste and conserve resources. “Raising awareness of PET’s recyclability and its role in a circular system is essential to shifting consumer perceptions and encouraging more environmentally responsible choices,” adds Mademoiselle Desserts’ Winsor.

Plas-ticked off

The message is pretty clear for the baking industry – single-use plastic needs to get packing.

Although retailers and brands may have not yet been able to eliminate plastic completely from their ranges, several are taking big strides in their journeys towards such a goal. Notable cases over the last year include M&S moving to recyclable paper for its garlic butter baguettes, Sainsbury’s switching to cardboard and paper for some of its in-store bakery products, and selected loaves from Warburtons and Jason’s Sourdough employed new recyclable bread bags created by Mondi and Welton, Bibby and Baron.

And it’s not just in packaging of finished products where companies can benefit from partnerships with more sustainable suppliers. Plastic waste can also be minimised on incoming ingredients.

Among the most recent sustainability progress at Mademoiselle Desserts, which has been certified B Corp since 2022, is a transition from single-use plastic buckets to thin pergals delivered in reusable trays, cutting out around 4.5 tonnes of plastic per year. It also removed unnecessary side tabs to its plastic baking aids and reduced the gauge of flow wrap, pallet wrap, and tape, to save a further 3.2 tonnes annually.

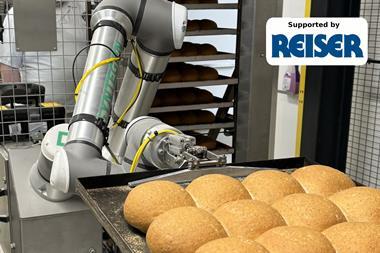

In addition, companies can make investments in new on-site equipment to facilitate a reduction in plastic packaging. The Compleat Food Group, for example, recently removed plastic trays from its pork pie packaging thanks to high-tech machinery at its Tottle bakery in Nottingham, which is set to eliminate 110 tonnes of plastic annually from its supply chain and reduce CO₂ emissions by 430 tonnes per year. Trays had previously played a role in stabilising products during flow wrapping. “Without them, production speeds would have dropped by 30%,” admits Moore. “The introduction of robotic automation has helped bridge this gap, allowing for precise handling and packing of products without compromising speed or quality.”

There’s also a consumer-driven move away from plastic in out-of-home bakery packaging, with foodservice operators embracing fibre-based options like takeaway trays made from bagasse (fibrous pulp matter leftover from sugarcane stalk crushing).

“FSC certified and recycled fibre are even better alternatives,” notes Lea Maguero, head of sustainability at Decent Packaging/Bio Pak, a B Corp that supplies compostable packaging. Consumers still need to be educated on how to dispose properly of the packaging, she reminds.

Material concerns

Simply removing plastic from bakery packaging isn’t enough to get to a circular economy, though. You also need it to be fully recyclable.

This has been taken on board – or rather on cardboard – by the likes of Higgidy in packaging for its updated pie range and Pladis for its new Jacob’s Bites snacks. Ingredients suppliers have rolled out 100% recyclable packaging for their products too including for Eurostar Commodities’ sacks of Rise Re:Gen flour and Rainbow Dust’s boxes of cake decoration items.

However, when it comes to bakery manufacturing on behalf of customers, changing packaging can present several challenges. It often involves costs that can be easily overlooked, says Mademoiselle’s Winsor, such as the expense of artwork and print plates, the financial impact of disposing of redundant stock, and the costs of conducting trials. “When updating outer packaging, it’s essential to ensure that the new design maintains the required standards and does not compromise the primary function of packaging – protecting the product inside,” she emphasises.

The wider picture

Bakers can look to other industries for sustainable packaging inspiration – for example, reusable trays have successfully been adopted for local deliveries of fruit, veg, and dairy.

This approach may be highly effective, but it is not always practical for bakery manufacturers who distribute products nationwide as it makes traceability and returns more challenging. “Additionally, smaller businesses, such as cafés, may lack the space and facilities needed to store reusable packaging for collection and reintegration into the circular economy,” says Winsor.

Solutions that work within the unique supply chain constraints of a company need to be developed instead. Moore recommends large manufacturers to take a holistic approach to packaging sustainability, using data-driven insights and cross-functional teamwork to drive change. “At Compleat, a key part of this strategy is the introduction of a group packaging dashboard, which tracks packaging usage across all materials, with a particular focus on plastics. This enables the business to monitor progress, identify areas for improvement, and ensure accountability,” he says, adding “Collaboration is key for long-term, scalable solutions.”

Whether it be rethinking materials or trimming out excess, investing in automation or preparing for upcoming policy changes, bakeries across the nation should make the necessary moves to ensure their packaging is the right fit for their business.

Advertisement: Integrate sustainability data into your supply chain management

Tired of chasing elusive sustainability data from your suppliers and grappling with the upcoming EUDR requirements?

TraceGains Sustainability Management simplifies how you approach sustainability with real-time access to data from across our global network. Source sustainably, design responsibly and report confidently.

- Compare suppliers and products based on key metrics – such as Scope 1-3 carbon emissions, ingredient impacts, and alignment with initiatives like CDP and SBTi – to drive smarter sourcing decisions

- Enhance your product design by integrating detailed Life Cycle Analysis and carbon impact data directly into your workflows, making it easy to ensure that every product meets both sustainability and compliance standards

- Stay ahead of regulations like CSRD, CSDD with streamlined data collection and automated EUDR reporting

Empower your sourcing, product design, and reporting with TraceGains Sustainability Management. Automate data collection, perform comprehensive life cycle analyses, and stay ahead of evolving ESG regulations – all while driving sustainable growth.

No comments yet