If you ever need proof that the baking industry is booming, just take a look at IBA. Over the last week, more than 49,000 visitors from 149 countries flocked to Düsseldorf to find out about the latest innovations and opportunities up for grabs.

The seven halls were packed with some serious tonnage when it came to equipment from full bread plants to spiral coolers, giant mixers, pastry lines, and more. If this meant anything it was that there is some serious cash to be made as firms look to expand and improve efficiency through automation – a continuing theme but one which persists due to rising labour costs and recruitment issues.

Sustainability was another theme that could be felt across the halls from solutions to reduce waste, extend the shelf life of products, or improve energy efficiency.

It was an intense two and a half days for the British Baker team as we navigated the halls, networking, learning, and doing our best not to be distracted by the unexpected number of ice cream samples available. Having had a couple of days to reflect, here are some of my takeaways from IBA 2025:

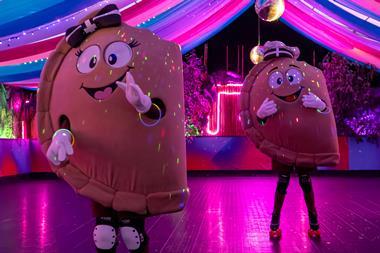

Cocoa replacements are on the rise

Walking the ingredient and trends halls at IBA in Düsseldorf made one thing clear – cocoa substitutes are big business.

Considering where cocoa prices are right now, the timing couldn’t be better but many of these products aren’t a kneejerk reaction to the global commodity market. Instead, they are being touted for their sustainability credentials and cost savings.

ChoViva, for example, showcased its ‘chocolatey taste experience’ made from sunflower seeds, sustainable plant-based fats, sugar, and milk powder or sunflower seed flour (for its vegan-friendly version). Having identified that much of the flavour of chocolate comes from the way cocoa beans are treated (fermented then roasted), it set about looking to replicate this to make a product which ‘is not a replacement for chocolate’ but a ‘sustainable alternative ingredient that paves the way for more climate-friendly manufacturing’. According to the brand, its patented recipe requires 94% less water and 80% less CO2 to produce thanks, in part, to its shorter supply chains.

It’s testing the water in the UK with a handful of confectionery lines and has partnered with sweet goods manufacturer Baker & Baker to roll out doughnuts with ChoViva in Germany, so there’s likely more to come on this front in the future.

Another sustainable solution on show was Agrain’s Cocoa Replacement made from brewers’ spent grain containing malt as well as cocoa husks. It’s not designed to be a full replacement, as the Danish firm suggests replacing 50% cocoa with the product in the likes of brownies, cookies, and more.

Rounding off the highlights (although these are far from the only cocoa substitutes on display) is Cargill’s Indulgence Redefined. Developed in partnership with food technology company Voyage Foods, it is described as a confectionery alternative to chocolate and made from plant-based ingredients such as grape seeds and sunflower kernels. It has the added benefit of being allergen free, an advantage as the range also includes confectionery fillings such as one with a hazelnut taste and another with peanut taste.

AI is changing the industry one step at a time

AI is the buzzword in almost every industry right now – and it’s making its way into the baking industry, as evidenced by some of the technology on show at IBA.

From camera-assisted ovens to real-time stock updates and even staff management, there was a wealth of technology designed to make the lives of bakers easier and production more efficient.

Equipment supplier Debag, for example, has created an assistance system to help reduce user error and improve the consistency of baked goods across multiple-site estates. According to the firm, over 50% of baking processes are affected by user error, despite user-friendly controls. To combat this, it collaborated with PreciTaste to create Oven Station Assistant.

The system uses AI and camera technology to recognise the type and quantity of goods to be baked as soon as the trays are loaded. The oven parameters are then set automatically. For example, the camera would recognise that a tray is loaded with croissants and set the oven accordingly. But if another tray on the same rack is loaded with something which requires a different temperature or baking time, this would be flagged, and baking would be unable to begin until this was resolved.

Also at the exhibition, AI-based planning specialist Aiperia was showcasing its new in-store bakery cabinet. It utilises Umdasch scale technology to monitor the items going in and out of the unit and matches them with POS data and Aiperia’s planning technology to understand buying patterns, help schedule production to maximise sales and reduce losses. Pilots with two large German retailers are due to get underway this year to test the benefits of the system before a potential wider roll out.

AI is also changing the way businesses interact and onboard their staff. AHA 360°, found in the aptly named digitalisation area of IBA, showcased its AI assistant for store employees. The assistant can be accessed via any smartphone, all employees have to do is scan the QR code, to ask any questions with answers provided in multilingual options as well as in text, image, and video form. Staff can also receive information about onboarding, training, lighting, daily routines, and more.

Consumers are concerned about costs, but can be convinced to spend

Ninety-four percent of consumers are concerned about the cost of living, but they can be tempted to splurge if the time and proposition is right – these are the messages from Eric Bell, president of the American Bakers Association (ABA).

Pointing to the trade body’s research colloquially known as ‘bakery playbooks’, he highlighted a divergence in consumer spend. For example, 30% of US consumers polled are purchasing food from restaurants less than a year ago while 23% are eating out more. In the supermarkets, it’s the premium and value tiers of products which are performing well as shoppers trade up or down depending on their circumstances, resulting in the middle being squeezed.

Further divergence comes in the form of indulgence and better-for-you bakery which are both driving growth – a movement echoed in the UK market. Leaning into the indulgent side of things, Bell pointed to impressive growth for pizza and doughnuts in the US market.

“Reward and escape” are also deemed to be key purchase motivators leading to a boom in products targeted at specific occasions including Christmas, St Patrick’s Day, Easter, and Fourth of July.

“Even though times might be tight, and they [shoppers] are worried about inflation, they’re still looking to celebrate those special occasions with baked goods,” Bell said.

Much of this can be felt in the UK and Europe as well as further afield as confirmed by Dawn Foods global bakery trends, which were revealed at IBA. Dawn’s global market research & insights team analysed syndicated data from renowned sources and conducted research, including more than 2,500 consumer surveys, as well as hundreds of site visits to understand the market.

The research found that nearly 80% of consumers buy baked goods for social gatherings and a similar amount noted they like sweet baked goods that remind them of childhood. Dawn Foods said the opportunity for bakers was clear – to blend the familiar with the fresh by reimagining classics and tapping into shared memories to bring people together through bakery. It also highlighted that consumers are elevating their everyday choices with premium ingredients, bold flavours, and creative textures resulting in 72% of consumers seeing sweet baked goods as affordable luxuries.

Health by stealth – small changes make big differences

The next raft of HFSS legislation is coming for the UK (albeit slightly later than planned), but the need to make baked goods healthier across Europe and beyond could definitely be felt on the floor at IBA. From sugar replacements to sodium reduction, the innovation was plain to see. It might not be so plain to the end consumer, although that isn’t necessarily a bad thing as ‘better-for-you’ baked goods still have some negative connotations.

Examples included Saltwell’s sea salt which is extracted from a hypersaline body of water under the Atacama salt flats in northern Chile and boasts a naturally reduced sodium content (35% less than standard salt, according to the company).

FoodSolute’s aptly named SugarCut was another product on display. It claims to offer 1:1 sugar replacement in baked goods while helping to preserve the taste, texture, volume, mouthfeel, and colour provided by sugar. It’s made from wheat flour, inulin, dextrin, and natural flavouring.

One supplier described the trend as like the “trojan horse”. Unlike baked goods with added protein or fibre which consumers may actively seek out, those with reduced levels of fat, sugar, and salt may still be viewed as ‘less than’, making it a difficult proposition to get shoppers on board with. Therefore, discreet recipe reformulation may yield more widespread benefits than those actively shouting about their healthier credentials on pack.

This is balanced with a growing trend of certain shoppers paying closer attention to the ingredients, partly as a result of the clean label and UPF debates. As such, many of the products on show at IBA proudly declared that they were clean label and could be presented as such on pack.

No comments yet