Today’s consumers focus increasingly on how their mental and physical wellbeing is affected by what they consume. So how does that translate into the world of bakery products? In its latest in-depth report, Lesaffre set about finding out.

As the consumer focus on health and wellbeing ramps up, so does their search for and discovery of foods that are advantageous to both their physical and mental state.

While the food industry has long addressed the need for foods that aid physical enhancement – dietary, lower sugar, lower fat etc – there is increasing realisation that the mantra ‘you are what you eat’ is becoming embedded in the social psyche. For example, recent insights from NielsenIQ reveal that “mental health has moved from the sidelines to centre stage in the global wellness conversation” and it further revealed that “65% of women consumers now actively seek products or services to improve their mental well-being, marking a 33% increase from just three years ago”. As a result, there is increased demand for food and drink products that feature added benefits, such as high fibre or probiotics.

In addition, recent debate highlighted in the media has put the focus on ultra-processed foods (UPFs), with consumers increasingly driven to purchase what they perceive to be clean-label foods with natural ingredients, as well as those with clear provenance. In fact, one report, highlighted in British Baker sister magazine Food Manufacture, has revealed that clean-label products will make up 70% of food and drink ingredient portfolios within the next two years.

Business response to health & wellbeing trends

The Food and Drink Federation (FDF) recognises that businesses have been investing in healthier product innovation for decades, often spurred on by UK Government reformulation programmes and regulatory moves such as HFSS. This, it says, has been achieved by changing recipes, creating new, healthier products, and providing smaller portion sizes. In fact, the FDF notes that food and drink manufacturers invested £180m towards healthier product innovation in 2024 alone. The FDF itself has contributed to this move with its own Action on Fibre initiative, launched in 2021, to help bridge a clear gap between fibre intakes and dietary recommendation. The result, it says, has been 400 new and reformulated products launched to market, with 118m servings of fibre delivered to the nation in 2024.

However, as it notes, high costs are limiting investment opportunities and says government can support food and drink manufacturers by establishing a reformulation programme to support SMEs (based on the Reformulation for Health programme in Scotland) and develop mandatory health food sales reporting in collaboration with industry and others.

How consumers perceive health & nutrition in bakery products

With this in mind, Lesaffre recently embarked on its own investigation into health nutrition in bakery products, using the help of Vypr consumer insights, and the findings to date have put the spotlight on some key opportunities.

The research set out to identify UK consumers’ purchase habits, preferences, and desired health claims in bakery products; explore consumers’ perceptions of bread as an ultra-processed food; and investigate the influence of health claims across various bakery product categories and consumption occasions.

For example, the study established that consumers now prioritise health & nutrition above all else when buying food and drink, with 35% considering that health factors have become more important to their purchasing decisions over the past 12 months [Mintel] and 33% citing nutritional content or benefits as a high priority.

Moreover, when it comes to bakery products Lesaffre’s research [Lesaffre] revealed that when presented with the statement ‘I’m willing to pay more for bread with extra health benefits’ 36% of respondents either strongly agreed or agreed with the statement and, overall, 58% of consumers purchase bread with [health/nutritional] claims .

What does the term ‘healthy bread’ mean to consumers

In the Lesaffre research, out of 68 responses, 27 identified healthy bread as a product with clean labels, while 16 cited natural ingredients and 15 pointed to nutritional benefits such as fibre, seeds, or protein, for example. Popular formats viewed as healthy included wholemeal, brown, sourdough and seeded varieties (18 statements).

Bakery ingredients and UPF: consumer perceptions

In terms of bakery product ingredients, the research discovered that fibre is a leading healthy priority, with low sugar content and low preservatives following closely behind. “These top three benefits together accounted for over 40% of total selections, indicating clear areas for product innovation and market focus,” says Lesaffre UK & Ireland marketer Jorge Semiao. “As fibre is the most prioritised nutrient when buying bread, chosen by 33% of respondents, this highlights its strong appeal for consumers seeking digestive health and nutritional value .”

Meanwhile, when it comes to diet & lifestyle, 46% of respondents identified gut health as the leading priority, with digestive wellbeing leading the field, chosen by nearly 4 in 10 of those surveyed. “This indicates strong consumer interest in fibre and gut-friendly ingredients,” notes Semiao.

And while just over half of consumers (53%) were aware that bread is fortified with nutrients, such as calcium, iron and vitamins, nearly 47% were nearly unaware or unsure, highlighting an opportunity for better communication and labelling – particularly for the 30% of respondents who actively seek fortified bread.

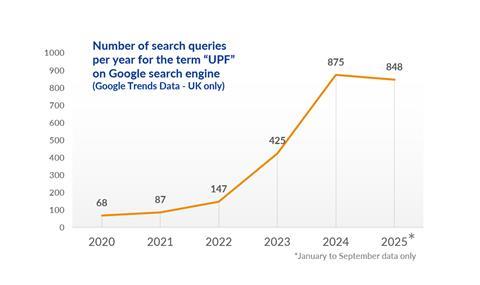

Further detail in the survey includes priorities when purchasing bakery products other than bread, such as sweet bakery, pizza, and croissants & pastries, alongside consumers’ perceptions of bread fortification, product labels and UPFs. In fact, it highlights that additives are consumers’ top marker of processed foods, with analysis of Google trends showing that search queries per year for the term ‘UPF’ rising from just 68 in 2020 to 875 last year. When it comes to bread, consumers most strongly associate long shelf life and additives with ultra-processing . However, overall uncertainty about whether bread can be classed as a UPF shows that there is an opportunity for education and simpler labelling on products to enhance consumer trust.

Key takeaways

● 58% of consumers purchase bread with claims, of which 39% buy it frequently

● Fibre and digestive health are the top preferences when purchasing bakery products

● Although consumers value the health benefits of bakery products, the top purchase decision is still driven by taste and price.

The role of healthy bakery products

So how can bakers innovate in a way that feeds into this focus on health more successfully?

Media articles repeatedly point to the growing interest in different aspects of healthy bakery, including ‘breads with bits’, sourdough, and low-sugar options such as oatmeal cookies sweetened with fruit.

As a recent article in British Baker pointed out, inclusions in bakery products are added for many reasons, but among them are the enhancement of flavour and boosting nutritional value. And, with Brits demanding mor diet-friendly products, the free-from bakery goods market has seen a spending surge of £24.7m [Kantar] .

Dr Gulten Yagmur, Baking Center™ & innovation manager at Lesaffre UK & Ireland, suggests that sourdough breads can also play a key role in meeting many of these consumer requirements. He points to several studies that show how sourdough breads can contribute to nutritional wellbeing, including the reduction of the glycaemic peak and prolonging satiety.

Overall, the attributes that sourdough breads bring to the table in terms of taste and health perception are playing strongly into the modern consumer zeitgeist, with its components – naturally occurring bacteria, yeast, flour and water - being clean and simple and the high perception of its health benefits feeding into strong and positive associations for many consumers.

As a result, bakery businesses looking to attract interest from today’s health-conscious demographic should certainly be considering clean-label innovation, healthy bakery inclusions, and sourdough among the products offered to their customers.